Several tax models are available to support countries around the world. Use the Billing-Tax preferences to specify the tax model your firm uses, the labels that display for taxes on an invoice, and the rate to be used.

Changes to tax preferences only apply to new projects, not existing ones.

To change the tax model for an existing project, navigate to the Projects

-Billing-Options view and click the Tax

tab.

Changes to tax preferences only apply to new projects, not existing ones.

To change the tax model for an existing project, navigate to the Projects

-Billing-Options view and click the Tax

tab.

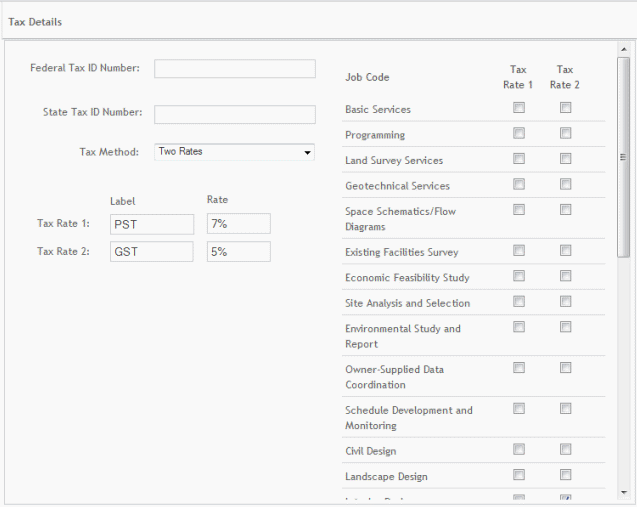

Tax Details

Federal Tax ID No:

Enter you firm's Federal tax ID number in this field.

State Tax ID No:

Enter your firm's State tax ID number in this field.

Tax Method:

Select the default tax method to be applied to new projects from this drop-down list. The tax model can be changed for a project by an authorized user to one of the following: No Tax, Flat Rate, Two Rates or Slip Specific.

Options available on this screen vary based on the tax method selected.

Options available on this screen vary based on the tax method selected.

No Tax: Select if your firm does not apply a tax rate to its services.

Flat Rate: Select this option to apply a flat tax rate to all services and expenses. Enter a tax rate label (for example, CA Sales Tax) and specify a rate.

Two Rates: Select this option if your firm charges two different tax rates. You can apply one or both of these rates to job codes. Enter tax rate labels (for example, PST, GST, etc.) and specify the rates to be applied.

Slip Specific: Select this option if your firm charges different tax rates by job code or time and expense. You can also establish default rates for all time and expense entries. Enter labels (for example, PST, GST, etc.) and specify the rates to be applied.

The Slip Specific method can also be used to have one tax rate for all time entries regardless of job code, and a different tax rate for all expense entries regardless of code. To do this, just leave the tax rate fields for the job code listings shown here, at 0.00%, and the Time Slips rate will be used for all time entries, and the Expense Slips rate will be used for all expenses.

Job Codes Grid

This list only displays when either the Two Rates or Slip Specific tax methods are selected.

Two Rates: You can specify which job codes should have taxes applied to them as a default by selecting one or both of the tax rate check boxes for a job code.

Slip Specific: When this tax method is selected, you can specify slip specific tax rates by job code. When the job rate codes are left empty, the default time and expense rates are used.

Button Panel

Save:

Stores your settings.

Help:

Opens the ArchiOffice Help in the Preferences section.